Convert Leads Faster with Pay Later Payment Integration at the Checkout

Convert Leads Faster with Pay Later Payment Integration at the CheckoutImagine yourself at the checkout page of the SaaS tool you need for your team, but the cost of an annual package necessitates approval from finance. Enter- SaaSPay's 'Pay Later'. Get the tool sans the financial burden. This is what SaaSPay does for your customers.

If you are working at a product-led organization, you know a 'pay-later' integration can turn the tables when it comes to the number of leads that convert. More than a Pay Later payment integration, think of it as a growth catalyst.

The SaaS Sales Dilemma: Breaking the Upfront Payment Barrier

Think of a business problem, and there is likely a SaaS solution that is built specifically for it. From streamlining operations to driving efficiency or specifics like SEO, there is a SaaS for everything.

Now, look at it from a buyer's perspective, as the number of SaaS and cloud tools keeps increasing on the debit side of the balance sheet, businesses opt for monthly payment plans to break up the expenditure into smaller, palatable chunks. The traditional annual upfront payment model is a tougher choice, especially for small and medium enterprises (SMEs) operating on tight budgets.

But, as a seller, selling more annual subscriptions mean top-line revenue in a short span, giving you a better growth moratorium. This is where the concept of 'Pay Later' sweeps in like a hero, breaking down financial barriers and opening up a world of possibilities.

How SaaSPay's PayLater Changes the Game?

1. Increased Sales Conversions

The flexibility of paying later can significantly reduce cart abandonment rates, turning potential customers into loyal patrons.

2. Enhanced Customer Trust

Offering financial flexibility not only fosters trust but also demonstrates a commitment to customer-centricity, a cornerstone of long-term business success.

3. Cash Flow Management

For customers, the option to pay later provides much-needed breathing room for cash flow management, enabling them to invest in essential SaaS tools without immediate financial strain.

SaaSPay: Your Partner in the Revolution

SaaSPay isn't just about offering a Pay Later option; it's about forging a partnership that propels your business forward. We understand the unique challenges and opportunities in the SaaS landscape, and our solutions are designed to:

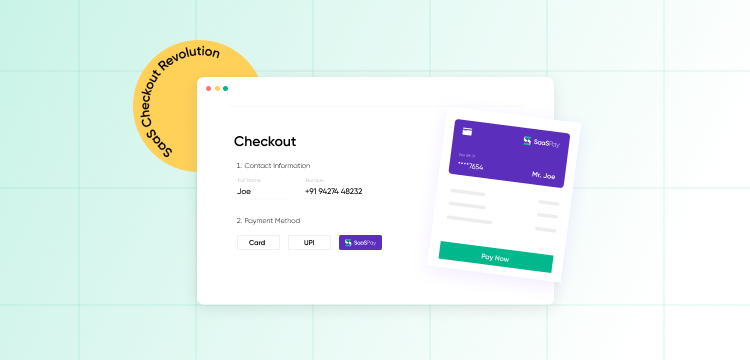

1. Seamlessly Integrate

Our Pay Later integration is as smooth as silk, ensuring a hassle-free checkout experience for your customers.

2. Customize to Fit

We know one size doesn't fit all. That's why our solutions are tailored to meet the specific needs of your business and your customers.

3. Empower with Insights

Beyond payment processing, SaaSPay offers valuable insights to help you understand customer behavior and preferences, enabling informed decision-making.

About SaaSPay for PLG

With SaaSPay leading the charge with pay-later for product-led companies, both businesses and customers are experiencing a new era of financial flexibility and opportunity. Infact, the benefits extend far beyond the checkout page. We're talking about cultivating an ecosystem where businesses can thrive, innovate, and scale without being hampered by financial constraints.

Building Long-Term Relationships: By alleviating financial pressure, you're not just making a sale; you're building a relationship. Customers are more likely to return and explore additional services when they feel supported.

Driving Innovation: Freed from the shackles of upfront payments, businesses can invest in innovation, explore new markets, and push the boundaries of what's possible.

The SaaS Checkout Revolution is more than a shift in payment processing; it's a movement towards greater agility, opportunity, and growth. By embracing Pay Later integration with SaaSPay, you're not just adapting to the changing landscape; you're leading the charge, unlocking new realms of potential for your business and your customers.

Ready to Join the Revolution?

Embark on this transformative journey with SaaSPay. Book a meeting with our team and discover how Pay Later payment integration can be the key to unlocking unparalleled growth for your SaaS business.

SaaSPay for Buyers

Why BNPL for SaaS?

How is BNPL transforming B2B payments?