How is BNPL transforming B2B payments?

How is BNPL transforming B2B payments?

Buy Now, Pay Later (BNPL) is a payment option that is quickly gaining popularity in the B2B space, and it is transforming the way that businesses buy and sell SaaS tools. Imagine a BNPL merchant as a wise wizard, ready to grant a wish to the business seeking growth. When a business opts for BNPL, this wizard, or the BNPL provider, waves its wand and pays the vendor in full upfront. In return, the business undertakes a promise to repay the BNPL provider in manageable easy installments.

How Does Buy Now, Pay Later Work for B2B Payments?

BNPL for B2B payments works similarly to BNPL for consumer payments. When a business makes a purchase using BNPL, the BNPL provider pays the merchant in full upfront on behalf of the business. The business then repays the BNPL provider in flexible installments. This accessibility to split payments makes it easier for businesses to afford substantial purchases, fostering an environment where it grows. As businesses sweeten the deal with BNPL, they find that customer loyalty spikes to new highs. Flexible payment options create lasting bonds with customers who appreciate the freedom to choose how and when they pay.

Moreover, churn, the silent thief of subscription-based businesses, is quelled by the power of BNPL for B2B. Subscribers can now continue their relationships with businesses without the agonizing lump-sum annual payments, reducing the likelihood of cancellations.

Furthermore, BNPL grants SaaS sellers immediate access to the full purchase amount, regardless of how customers choose to settle their payments.

BNPL vs Other Payment Options

In the battle of B2B payment options, BNPL for B2B stands out as the versatile charmer. It's flexible, accommodating, and eager to please customers. Picture BNPL as the adaptable actor on a stage, seamlessly fitting into various roles. Still not convinced?

Here's a comprehensive breakdown with some traditional business payment options:

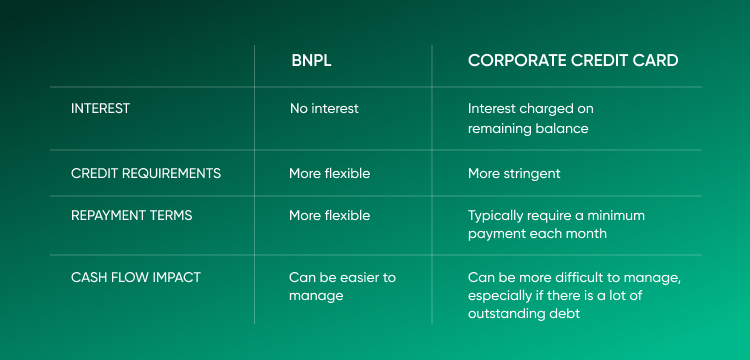

BNPL vs Corporate Credit Cards:

Buy now, pay later for B2B and corporate credit cards are popular ways businesses finance purchases. However, there are some key differences between the two options.

One of the biggest advantages of BNPL is that it offers a longer debt-free path to finance than corporate credit cards. Unlike corporate credit cards, BNPL providers typically do not charge interest for a longer fixed period. This can be a major advantage for businesses looking for considerable payment flexibility.

Another advantage of BNPL for B2B is that it can be easier to qualify for than a corporate credit card. BNPL providers typically have more flexible credit requirements. This means that businesses with poor credit or no credit history may still be able to qualify for BNPL financing. BNPL often requires minimal credit checks, making it accessible to a broader range of businesses.

BNPL can also be a more flexible option for businesses than corporate credit cards. BNPL providers typically offer a variety of repayment plans, so businesses can choose the plan that best meets their needs as opposed to the 30-45 day payback cycle of corporate credit cards. On the other hand, corporate credit cards typically require businesses to make a minimum payment each month, but the remaining balance may accrue interest. This can make it difficult for businesses to manage their cash flow, especially if they have many outstanding debts.

BNPL vs Revenue-Based Financing:

Buy now, pay later (BNPL) for B2B and revenue-based financing are popular financing options for businesses of all sizes. Both options can help businesses manage their cash flow and grow their operations. However, there are some key differences between the two options.

Revenue-based financing is a type of loan that is based on a business's future revenue. The lender advances the business a certain amount of money, and the business repays the loan with a percentage of its future revenue. Revenue-based financing providers also typically charge interest on their loans.

One of the biggest advantages of BNPL for B2B is that it empowers businesses to manage cash flow without sacrificing a portion of their future revenue. BNPL providers typically have a zero-interest payback window, followed by flexible and low-interest rates for the remaining tenure.. This means, that sellers' businesses letting their customers opt for BNPL for payments increases the flexibility of the buying experience and lowers the risks with buy now pay later. As for the buyers, they get payment flexibility without the need to give away a fair share of their projected revenue. This means that businesses need to be careful when considering revenue-based financing, as it can significantly impact their profitability.

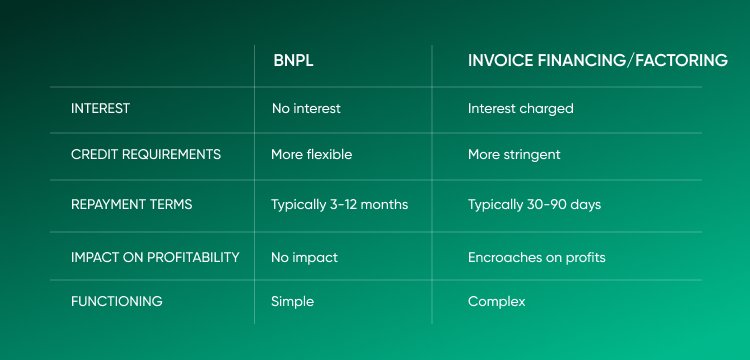

BNPL vs Invoice Financing/Factoring:

Buy now, pay later (BNPL) for B2B and invoice financing/factoring are two popular financing options for businesses of all sizes. Both options can help businesses improve their cash flow and grow their operations. However, there are some key differences between the two options.

Invoice financing/factoring is a type of financing that allows businesses to sell their unpaid invoices or projected a/c receivables to a lender in exchange for immediate cash. The lender then collects the payments from the business's customers on the due date. Invoice financing/factoring providers typically charge a fee for their services based on the amount of the invoice and the length of the financing term.

One of the biggest advantages of BNPL is its simplicity. The process of applying for and using BNPL is typically very straightforward. Businesses need to onboard themselves with a BNPL for B2B provider and then choose the terms of payment as per their convenience before they start clearing invoices via the BNPL provider’s portal. Invoice financing/factoring, on the other hand, can be a more complex process. Businesses typically need to apply for invoice financing/factoring and provide the lender with detailed information about their business and customers. The lender may also require the business to provide collateral.

If you are looking for a simple and easy-to-use financing option, BNPL may be a good choice for you, as in buy now pay later, risks are low.

BNPL vs Term Loans:

Buy now, pay later BNPL for B2B and term loans are two popular financing options for businesses of all sizes. Both options can help businesses improve their cash flow and grow their operations. However, there are some key differences between the two options.

A term loan is a type of loan that is repaid over a fixed period of time, with a fixed interest rate. Term loans can be used to finance various business expenses, such as equipment, inventory, and expansion.

One of the most significant advantages of BNPL for B2B is its flexibility. Businesses can set their payment schedules based on their specific needs. This can be especially helpful for businesses with seasonal revenue or experiencing rapid growth. Term loans, on the other hand, typically have more rigid payment schedules. This can challenge businesses with unpredictable cash flow, making the buy now pay later risks lower.

In short, these advantages of Buy now pay later for B2B make it easier for businesses to attract new customers and increase sales, as customers are more likely to purchase items they can afford to pay for over time.

1. Improved cash flow: BNPL can help customers improve their cash flow by allowing them to spread the purchase cost over time.

2. Easier access to credit: BNPL can provide access to credit for customers who may not have access to traditional credit options, such as credit cards or bank loans.

3. More flexibility: BNPL allows customers to choose how much they want to pay upfront and how many installments they wish to spread the purchase cost over.

BNPL is also more convenient for customers than other payment options. Customers can typically apply for BNPL financing like SaaSPay at the seller’s checkout, and pay via a credit line almost instantly. This can help to reduce cart abandonment and improve the overall customer experience. If your SaaS seller doesn’t offer BNPL yet, you can request to pay via SaaSPay.

How B2B Buy Now Pay Later is Bringing Massive Transformation in SMEs?

For startups and small and medium-sized enterprises (SMEs), cash is the fuel that propels growth and innovation. However, like a fledgling bird learning to fly, startups often struggle to steady their cash flow. Traditional financing channels like bank loans might seem like a sturdy ship, but they often leave SMEs stranded on the shore. This is where the magic of Buy Now, Pay Later (BNPL) for SMEs comes into play, acting as the wind beneath their wings, propelling them towards success.

If you're running a startup, your dream is taking its first steps into reality. You're eager to innovate, expand, and make your mark in the industry. But there's a catch - you need cash and lots of it. This is the reality many startups face. They're cash-strapped and facing the formidable challenge of accessing traditional financing options like bank loans.

Now, let's dive into the numbers to grasp the gravity of this cash flow predicament. According to a study by the National Small Business Association, around 19% of startups and small businesses struggle with cash flow problems, often leading to the dire consequence of business closure. Moreover, 82% of small businesses fail because of cash flow mismanagement, as a U.S. Bank study reported.

In this financial jigsaw puzzle, traditional financing methods often resemble missing pieces, making it a daunting task for startups to stay afloat. This is where Buy Now Pay Later for B2B steps in as the missing piece, bridging the gap between dreams and financial reality. With BNPL, startups can access credit swiftly and seamlessly. The ease of application and approval means you can spend less time navigating financial red tape and more time focusing on what truly matters - growing your business. Moreover, the ability to offer flexible payment options to customers can lead to a surge in sales, transforming a struggling business into a thriving one.

The impact of improved cash flow on startups is profound. It means paying employees on time, covering operational costs, and seizing growth opportunities as they arise. According to a survey by QuickBooks, 61% of small businesses worry about cash flow, and 32%struggle to pay vendors, often delaying payments. With BNPL for small businesses, these concerns can become a thing of the past.

BNPL and Embedded Financing

Embedded financing, offered by forward-thinking BNPL providers, emerges as a beacon of hope in this challenging landscape. It allows startups to integrate BNPL as a payment option at the checkout, offering their customers a flexible payment approach. This seemingly simple addition to the payment toolbox carries profound implications.

Imagine a startup's online store as a busy bazaar, bustling with customers. With BNPL embedded financing, it's as if the startup has unveiled a magical currency that customers prefer. This newfound flexibility in payments works like a charm, enhancing the overall shopping experience. And the numbers tell a compelling story: businesses that embrace embedded financing report a notable surge in their sales conversion rates.

According to a survey conducted by the National Retail Federation, merchants offering BNPL at checkout experienced a 20% increase in average order value compared to those who did not. This surge in spending reflects the power of BNPL-embedded financing in enticing customers to complete their purchases, even for higher-priced items. It's akin to a gentle tug on the shopping cart, guiding it smoothly from browsing to checkout. This makes it easier for their customers to access flexibility of payments and gives merchants more control over the sales conversion rate, improving their overall numbers. Businesses embracing BNPL-embedded financing are more likely to attract and retain new customers.

The Question of Buy Now Pay Later Risks

Now, let's address the elephant in the room – the specter of default. In the world of Buy Now Pay Later, risks of default loom overhead like ominous clouds. For sellers, this can be a cause for concern.

However, fear not, for BNPL providers have honed their risk assessment models to perfection. These models serve as vigilant lighthouses, guiding businesses safely away from the potential financial shipwrecks that defaults can bring. With BNPL, sellers can often receive their payment on the very first day, offering them a virtually zero-risk transaction experience.

In the End

In the grand story of commerce, BNPL for B2B takes center stage as the protagonist, ready to shake up how payments work. It's not just about buying and selling; it's about making some big changes. BNPL opens the door for more businesses to get important software without breaking the bank. It's like giving everyone a chance to use the latest and greatest tools.

And when businesses use BNPL, it's like hitting the fast-forward button on adopting new technology. This boost helps companies of all kinds grow and succeed, kind of like how a rising tide lifts all boats.

So, if you're part of the modern business world of tech, think about the possibilities with Buy Now Pay Later for B2B. It's not just a player in the game; it's changing how the game is played.

SaaSPay for Buyers

Why BNPL for SaaS?